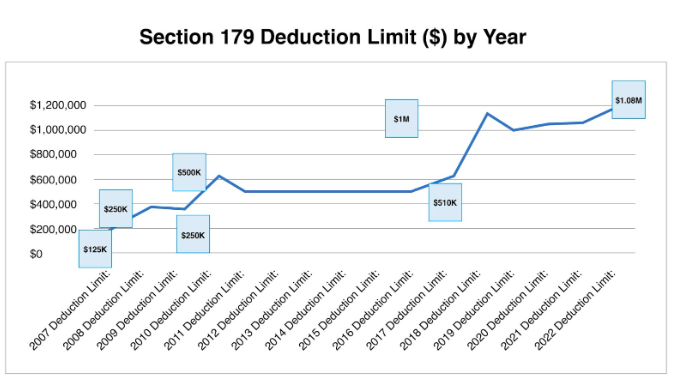

If you are wondering why all small businesses around you are rushing to make purchases, then you are in the right place. For those who have woken up from a 15-year slumber, Section 179 allows all businesses to deduct the total value of qualified purchases within certain limits while computing taxes. This has been around since 2008. This year the government provides several additional benefits to businesses, including the ability to deduct up to $1,080,000. This is the highest-ever deduction allowed so far. This number has varied each year and might not even be applicable in future years. For vending machine businesses interested in this Section 179 tax deduction in 2022, you have about six weeks to make eligible purchases.

Eligibility for Section 179 Deductions

Large businesses can enjoy the same deductions as small ones under Section 179. However, the deductions have been structured to specifically encourage small businesses and to boost their profitability.

Certain governing conditions define eligibility for this deduction. The total qualified equipment purchase for these businesses should be at most $3.78 Million. The following list shows the type of equipment eligible for this deduction:

Equipment (machines, etc.) purchased for business use:

- Tangible personal property used in business

- Business vehicles with a gross vehicle weight above 6,000 lbs

- Computers

- Computer “Off-the-Shelf” software

- Office furniture

- Office equipment

Vending machines are included within eligible purchases for the Section 179 Tax Deduction. This allows small vending businesses to spend money on capital enhancement and enjoy tax savings.

Off-the-Shelf software purchases are also eligible to put toward this deduction. Bespoke or custom-developed software and software services are not eligible, however.

Another qualifier is that the equipment purchased in FY 22 must also have been implemented in FY 22. The business must also have made a taxable profit in the same year. If the business cuts a loss, it will only be eligible for bonus depreciation. [1]

Limits in Section 179 for FY 2022

The minimum spending on capital equipment or software for which the Section 179 deductions applies is $2,700,000. The maximum amount for which the deductions apply is $3,780,000. This means there can be a dollar-to-dollar deduction for a total of $1,080,000 ($3.78M – $2.7 M) in FY 22.

This limit makes it very attractive for small and medium businesses, as large businesses often spend more than $3.78 Mn on Section 179 qualified equipment in a year.

Section 179 and Financed Purchases

The relevance of Section 179 deductions for cash-down purchases in the current year is straightforward. However, the government allows businesses to deduct for financed purchases too. The point is that businesses are eligible to deduct the total value of the equipment bought, including what is financed in the current year. This can be explained by the following example:

Assume that the value of 10 Vending Machines = $ 100,000 **

The total value of installments in the current year as a part of the financing agreement = $ 20,000 **

The value eligible for Section 179 Deduction = $ 100,000 **

Tax Savings when the tax rate is 22% = $ 22,000 **

** All values are assumptions to demonstrate deductions in the case of a financed purchase.

Thus, there can be instances where the Section 179 deductions can save more in taxes than the money spent toward that purchase in the current year. This depends on the terms of financing, though.

Savings for your vending business can be estimated by clicking on the link at the end of this article.

Electing to Deduct Under Section 179

Vending machine business tax deductions under Section 179 are not applicable by default. All businesses must elect for this deduction in form 4562 while filing the returns at the end of the year. This is a form a business must file when showing depreciation of assets or deductions under Section 179. Businesses can claim this deduction even when filing under an approved extension beyond the date for filing returns.

Investments eligible for the computation of deductions include the amount spent up to the date of filing returns. Expenses not considered in the years preceding the current year can be included in the current year. However, the investments made before 2007 cannot be considered. [2]

Next Steps for Your Vending Business

If you have not already purchased enough equipment to enjoy the benefits of deductions under Section 179, now is the time. The deduction does not only help you improve your P&L, but it can also help you save taxes and invest in your growth.

If you do not have disposable cash that you can use to purchase vending machines, that should not be a hurdle. You can finance your purchase using our attractive financing options and still claim deductions for the total value of the purchase as long as it is within the eligible limit for the current year.

Our vending specialists can help you estimate your savings and plan the purchase of your new or used vending machines. To know more, call us at 1-855-929-1042 or visit our website at www.vending.com.

Useful Links:

Part 1 of Form 4562: https://www.irs.gov/pub/irs-pdf/f4562.pdf

Information about Section 179: https://www.section179.org/

Tax Deduction Calculator: https://www.section179.org/section_179_calculator/

[1] – https://www.section179.org/section_179_deduction/

[2] – https://www.section179.org/electing_section_179_deductions/